Whereas there could also be exceptions, accessible knowledge means that dynasty-based administration will not be conducive to a know-how firm’s success.

Succession is a extensively acclaimed, well-liked and related TV present on HBO that highlighted the facility struggles inside a dynasty led agency. The present follows the Roy household, who management Waystar Royco, a world media and leisure conglomerate. The household is led by Logan Roy, a ruthless and domineering patriarch who’s nearing retirement. As Logan’s well being declines, his 4 kids start to jockey for management of the corporate. The present’s depiction of the Roy household’s energy struggles is a mirrored image of the real-world energy struggles which might be happening within the company world. The present additionally explores the methods by which wealth and energy can corrupt people and households.

Whereas the present is a cautionary story in regards to the risks of energy and wealth, it’s a reminder that even essentially the most highly effective households aren’t resistant to the harmful forces of greed and ambition. Over time, Reliance dynasty prospered below Mukesh Ambani, however is floundering below Anil Ambani’s management. This resulting in consider that it’s not all the time the legal guidelines of succession inside household is all the time profitable.

Prior to now, family-owned non-technology companies have been profitable. Members of the family typically work properly collectively and share a standard purpose. Nonetheless, this development has not been seen within the know-how business. Though relations could personal shares and serve on govt boards, the CEO place is often not handed down from one member of the family to the subsequent.

Nonetheless, know-how has now modified the place household companies as soon as had been handed on from one member of the family to the subsequent not like dynasty politics.

Though the highest family-owned know-how companies weren’t historically know-how companies, they had been diversified and rode the IT wave within the Nineties and 2000s. Reliance, Tata, Infosys, and Wipro are good examples.

– “The biggest 500 household enterprises generate US$8.02 trillion in income – up 10% from 2021.

– The influx of latest entrants, primarily from Europe (35%), is usually public (62%). Nearly half (47%) are from manufacturing, reflecting restoration within the sector.

– Ladies maintain solely 23% of board seats, indicating extra must be achieved to shut the hole.”

Take a look at the staggering but detailed listing of the highest firms on this report. International Household Enterprise Index.

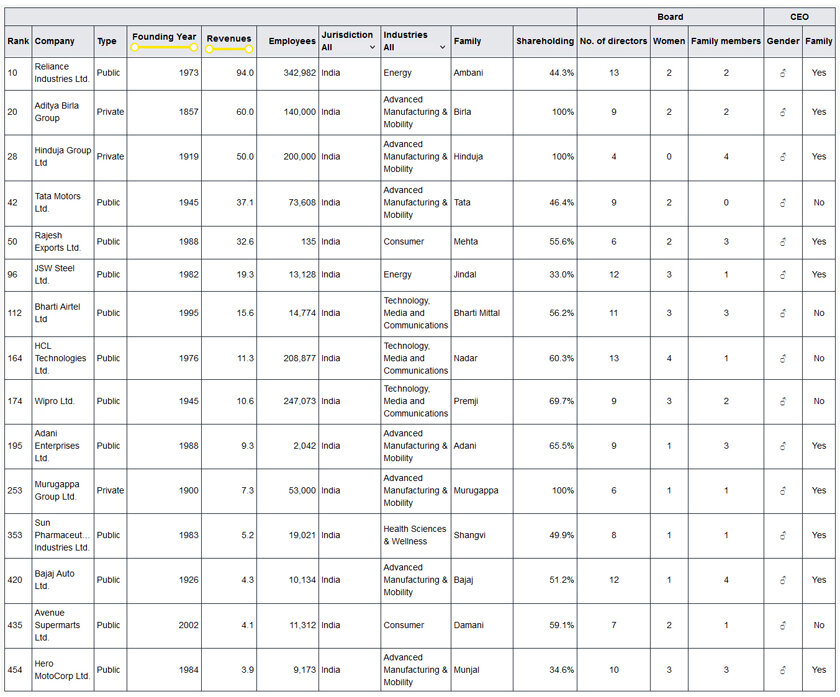

Other than Bharti, which is classed as know-how and telecom, HCL, Wipro, and Reliance are among the many most notable firms. Tata and Reliance, though they each have know-how wings, aren’t listed below the know-how banner.

India Tech and non tech itemizing:

Lets see some statistics internationally:

Of the businesses on the index, simply over half (55 %) have a CEO who will not be a member of the family. That is in distinction to firms like Koch Industries, Dell, Comcast, and Bosch, that are all nonetheless headed by a member of the family.

Older firms are much less more likely to be led by a member of the family. For instance, Indian conglomerate Aditya Birla Group, which ranks twentieth on the index, is one in every of solely 1 / 4 of corporations aged 150 years or extra which might be nonetheless helmed by a member of the household.

Notably, the proportion of firms and not using a household CEO is sort of as low among the many youngest firms.

Google, Apple, Tesla, what are the fashions that makes them thrive?

Google and Microsoft:

It’s attention-grabbing to know the succession plans of firms which might be within the high tech tier.

With Sundar Pichai and Satya Nadella on the helm of Alphabet (Google) and Microsoft, respectively, it’s clear that benefit alone can flip an organization’s fortunes round.

Pichai joined Google in 2004 and rapidly rose by the ranks, turning into CEO in 2015. Underneath his management, Google has continued to develop and innovate, turning into some of the useful firms on the planet. Nadella joined Microsoft in 1992 and served in quite a lot of management roles earlier than turning into CEO in 2014. Underneath his management, Microsoft has additionally reworked itself, turning into a extra customer-centric and modern firm. Though Invoice Gates holds the vast majority of the shares in Microsoft, it’s not his household that pulls the strings of the corporate. As a substitute, the board of administrators is accountable for making choices in regards to the firm’s route. The board is made up of impartial administrators who aren’t affiliated with Microsoft. These administrators are accountable for hiring and firing the CEO, approving the corporate’s monetary statements, and setting the corporate’s strategic route.

Gates’ household doesn’t have a major position within the day-to-day operations of Microsoft. Gates’ spouse, Melinda, is a co-founder of the Invoice & Melinda Gates Basis, and his kids aren’t concerned within the firm. Gates himself has stepped again from a day-to-day position at Microsoft, and he now focuses on philanthropy.

The board of administrators is accountable for guaranteeing that Microsoft is run in a accountable and moral method. The board additionally has a fiduciary responsibility to the shareholders of Microsoft. Because of this the board is accountable for defending the pursuits of the shareholders.

Each Pichai and Nadella are extremely proficient and skilled executives who’ve a deep understanding of the know-how business. They’re additionally each enthusiastic about utilizing know-how to make a optimistic influence on the world. Their management has been instrumental within the success of Alphabet and Microsoft, and they’re each position fashions for different executives who need to make a distinction on the planet.

Along with their expertise and expertise, Pichai and Nadella additionally share a dedication to variety and inclusion. They consider {that a} numerous workforce is crucial for innovation, and so they have each taken steps to make their firms extra inclusive. For instance, Pichai has created a variety and inclusion council at Alphabet, and Nadella has launched various initiatives to extend the illustration of ladies and minorities at Microsoft.

Pichai and Nadella are each proof that benefit alone can flip an organization’s fortunes round. They’re additionally position fashions for different executives who need to make a distinction on the planet. Their management and dedication to variety and inclusion are making a optimistic influence on the know-how business, and they’re inspiring others to do the identical.

Related story is that of Tesla which is a publicly traded firm, with Musk being the biggest shareholder. Though Tesla and Musk are actually just about synonymous, the billionaire didn’t initially set up Tesla; Marc Tarpenning and Martin Eberhard based the corporate in 2003.

Apple will not be a household owned firm both. The corporate is publicly traded, and its shares are owned by quite a lot of traders, together with people, establishments, and mutual funds. The biggest shareholder is Vanguard Group, which owns about 7% of the corporate’s shares. Different main shareholders embrace BlackRock, State Road Company, and Constancy Investments.

Apple was based by Steve Jobs, Steve Wozniak, and Ronald Wayne in 1976. The corporate was initially a household enterprise, with Jobs and Wozniak proudly owning the vast majority of the shares. Nonetheless, the corporate went public in 1980, and Jobs misplaced management of the corporate in 1985. He returned to Apple in 1997, and he led the corporate to a interval of nice success. Nonetheless, Jobs died in 2011, and Apple is now run by Tim Prepare dinner and it is without doubt one of the most useful firms on the planet.

Perils of a household owned Expertise enterprise and the long run:

First, know-how companies are sometimes extra advanced than non-tech companies. This complexity could make it troublesome for relations to work collectively successfully. Moreover, know-how companies are sometimes extra aggressive, which may create extra stress for relations.

Second, know-how companies typically require a excessive degree of experience. This experience will be troublesome for relations to accumulate, particularly if they don’t have a background in know-how. Moreover, know-how companies are always altering, which may make it troublesome for relations to maintain up.

Third, know-how companies will be unstable. This volatility could make it troublesome for relations to plan for the long run. Moreover, know-how companies will be troublesome to promote, which may make it troublesome for relations to exit the enterprise.

Nonetheless, there are some profitable household owned know-how companies. These companies are sometimes in a position to overcome the challenges of household possession by having clear roles and duties for every member of the family, by establishing robust communication channels, and by having a powerful dedication to the enterprise. Whereas there could also be some exceptions, the accessible knowledge means that dynasty-based administration will not be conducive to a know-how firm’s success.