The newest enterprise information because it occurs

Article content material

In the present day’s headlines

Commercial 2

Article content material

Article content material

4:40 p.m.

Market shut: TSX positive aspects greater than 100 factors as U.S. inventory markets combined

Canada’s important inventory index gained greater than 100 factors, led by energy in monetary, industrial and telecom shares, whereas U.S. markets have been combined, led by a achieve of just about 1.5 per cent on the Dow Jones.

The S&P/TSX composite index closed up 120.09 factors at 20,236.29.

In New York, the Dow Jones industrial common was up 520.47 factors at 35,950.89. The S&P 500 index was up 17.22 factors at 4,567.80, whereas the Nasdaq composite was down 32.27 factors at 14,226.22.

The Canadian greenback traded for 73.63 cents U.S. in contrast with 73.58 cents U.S. on Wednesday.

The January crude oil contract was down US$1.90 at US$75.96 per barrel and the January pure fuel contract was down a lower than penny at US$2.80 per mmBTU.

The February gold contract was down US$9.90 at US$2,057.20 an oz. and the March copper contract was up three cents at US$3.85 a pound.

The Canadian Press

3:25 p.m.

Netflix urges CRTC to acknowledge its current contributions to Canadian broadcasting

Streaming big Netflix Inc. says the Canadian Radio-television and Telecommunications Fee ought to acknowledge the function it already performs in serving to fund Canada’s broadcasting trade and reject calls to mandate a further fee from the corporate.

Commercial 3

Article content material

But when the federal regulator does transfer forward with requiring international streamers to contribute cash to the Canadian content material system, it says that burden needs to be not more than two per cent of annual revenues, consistent with different jurisdictions.

Netflix appeared Thursday at a listening to that’s a part of the CRTC’s public consultations in response to the On-line Streaming Act, which acquired royal assent in April.

The laws, previously often known as Invoice C-11, is supposed to replace federal regulation to require digital platforms to contribute to and promote Canadian content material.

Stephane Cardin, director of public coverage for Netflix in Canada, instructed the fee the platform already makes direct investments in Canadian content material by means of its funding of native productions, and a further levy may “end in displacement of sure investments.”

He urged the CRTC to take care of flexibility because it crafts guidelines for digital firms to help Canadian broadcasting, moderately than obliging them to subsidize sure funds accessible for native gamers.

The Canadian Press

1:40 p.m.

Ottawa shopping for Boeing surveillance planes to switch getting older Auroras

Article content material

Commercial 4

Article content material

The federal authorities is shopping for at the very least 14 Boeing Co. surveillance planes from the USA to switch the getting older CP-140 Aurora fleet.

The deal prices greater than $10 billion in complete, together with US$5.9 billion for the jets themselves, and the planes are anticipated to be delivered in 2026 and 2027.

Defence Minister Invoice Blair, Procurement Minister Jean-Yves Duclos and Business Minister Francois-Philippe Champagne held a press convention this afternoon to make the announcement.

Officers say Boeing’s reconnaissance airplane is the one accessible plane that can meet Royal Canadian Air Drive wants earlier than the Auroras attain their retirement age in 2030.

Officers stated in a media briefing immediately that the fleet will give Canada new capabilities within the Arctic to hunt submarines, and that allies together with Norway are already flying the planes within the far North.

The officers from the Defence Division, Air Drive and Procurement Division have been offering the data on the situation they not be named.

The choice to go along with a sole-source contract has closed the door on Quebec-based jet maker Bombardier Inc., which had been pushing for an open bid.

Commercial 5

Article content material

The Canadian Press

12:37 p.m.

Noon markets: Shares on the lookout for ‘subsequent leg up’ to shut out 12 months

Shares are drifting in afternoon buying and selling on Wall Road Thursday however stay on observe for his or her greatest month-to-month achieve in additional than a 12 months.

The S&P 500 fell 0.2 per cent at 4,540.93, however stays up greater than eight per cent in November. The Dow Jones Industrial Common rose 230 factors, or 0.7 per cent, to 35,662 as of 12:30 p.m. Jap. The Nasdaq fell 0.8 per cent.

The market has been marching steadily increased in latest weeks as buyers hope the USA Federal Reserve is lastly completed elevating rates of interest, which combat inflation by slowing the financial system. These hopes received extra help with a report that the Fed’s most popular measure of inflation cooled final month.

November’s rally has additionally been pushed largely by the know-how sector, the place a number of firms with excessive values are inclined to disproportionately impression the market. Microsoft Corp. is up 11.5 per cent and Nvidia Corp. rose 15 per cent for the month. Additionally, Treasury yields have typically been falling and easing stress on shares. Excessive yields are inclined to make costly shares look much less engaging to buyers.

Commercial 6

Article content material

“The rally has been dramatic in its transfer,” stated Quincy Krosby, chief international strategist for LPL Monetary.

The latest softness has basically been the market’s means of coping with an overbought situation, she stated, however it hardly suggests a deep sell-off forward.

“What you wish to see is that subsequent leg up as we shut the 12 months,” she stated. “November is a robust month for the market, however so is December.”

Canada’s important inventory index edged increased in early-afternoon buying and selling as energy within the telecommunications and monetary sectors was offset by weak spot in know-how shares, whereas U.S. inventory markets have been combined.

The S&P/TSX composite index was up 0.03 per cent at 20,123.68.

The Canadian Press, The Related Press

11:51 a.m.

Moe says Saskatchewan to cease amassing carbon levy for electrical warmth

Saskatchewan Premier Scott Moe says the province is to cease amassing the carbon levy on electrical warmth beginning Jan. 1.

He says many individuals in northern Saskatchewan use electrical energy to warmth their properties, and that they need to be exempt from paying the worth.

The premier says the province is to look at who makes use of electrical energy to warmth their properties, after which will determine tips on how to take the carbon worth off their payments.

Commercial 7

Article content material

In late October, Moe introduced the province received’t remit the carbon cost on pure fuel after Ottawa exempted residence heating oil.

Moe says the federal authorities’s exemption is unfair, because it primarily helps these in Atlantic Canada.

The province has launched laws to protect executives at SaskEnergy, its pure fuel utility, from being fined or going through jail time ought to the corporate not remit the cost.

The Canadian Press

11:15 a.m.

BRP revenue falls by half as shoppers soften away

BRP Inc. noticed its third-quarter income tumble by half from a 12 months earlier, because the leisure automobile maker felt the squeeze of sluggish client spending.

The monetary drop marked a pointy U-turn from the earlier quarter, when earnings jumped 42 per cent year-over-year and optimism rode excessive atop near-record gross sales for the interval.

“Client confidence declined since July,” chief government Jose Boisjoli instructed analysts on a convention name Thursday, citing weaker demand for the Ski-Doo maker’s merchandise.

Learn the total story right here.

The Canadian Press

10:05 a.m.

Markets open: Indicators of purchaser exhaustion emerge

Commercial 8

Article content material

“This month’s blistering rally in shares struggled to realize traction on Thursday, with merchants giving a lukewarm response to knowledge that bolstered bets the USA Federal Reserve is completed with its mountain climbing cycle.

Indicators of purchaser exhaustion emerged after a rally that put the S&P 500 lower than 5 per cent away from its all-time excessive, with equities little modified.

Treasuries reversed course on the finish of the month, with yields rising on hypothesis the market has moved too far, too quick in projecting Fed fee cuts. Oil climbed as OPEC+ agreed on additional provide cuts of 1 million barrels a day.

Inflation-adjusted private spending rose 0.2 per cent final month after a downwardly revised 0.3 per cent advance in September. The core private consumption expenditures worth index, which strips out the risky meals and vitality parts, rose 0.2 per cent.

From a 12 months in the past, the Fed’s most popular gauge of underlying inflation superior 3.5 per cent.

“That is prone to cement expectations that the financial coverage inflection level is shut, and the Fed will make at the very least one fee lower within the first six months of 2024,” stated Sonu Varghese, international macro strategist at Carson Group. “Fed officers have already acknowledged that inflation is easing, and that may occur within the face of a robust financial system and low unemployment, basically laying the groundwork for fee cuts.”

Commercial 9

Article content material

On Wall Road, the S&P 500 was up 0.12 per cent at 4,556.12. The Dow Jones Industrial Common was up 0.73 per cent at 35,869.70 whereas the Nasdaq composite was down 0.28 per cent at 14,218.63.

In Toronto, the S&P/TSX composite index was up 0.15 per cent at 20,152.50.

Bloomberg

8:30 a.m.

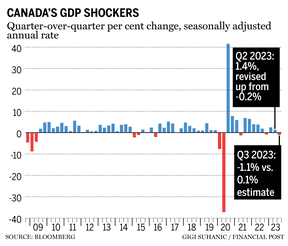

Canadian GDP falls 1.1% in Q3

Canada’s financial system shrank within the third quarter by 1.1 per cent on an annualized foundation, Statistics Canada stated Thursday.

A lower in worldwide exports and slower stock accumulation by companies have been partially offset by will increase in authorities spending and housing funding.

It additionally revised up its studying for actual gross home product within the second quarter, noting the financial system didn’t shrink, however moderately grew by 1.4 per cent on an annualized foundation.

In the present day’s report exhibits client spending continued to be flat for a second consecutive quarter. In the meantime, enterprise capital funding fell by two per cent.

Financial institution of Canada rate of interest hikes have been placing downward stress on client and enterprise spending as they each face increased borrowing prices.

Commercial 10

Article content material

The Canadian Press

7:30 a.m.

RBC, CIBC, TD elevate quarterly dividends amid combined earnings studies

Each Royal Financial institution of Canada and the Canadian Imperial Financial institution of Commerce raised their dividends after reporting an increase in revenue, whereas Toronto-Dominion Financial institution additionally raised its divided, although revenue fell.

RBC stated it had fourth-quarter revenue of $4.13 billion, up from $3.88 billion a 12 months earlier. The financial institution will now pay a quarterly dividend of $1.38 per share, up three cents from $1.35.

In the meantime, CIBC stated it earned $1.48 billion or $1.53 per diluted share for the quarter ended Oct. 31 in contrast with a revenue of practically $1.19 billion or $1.26 per diluted share a 12 months earlier. It raised its dividend to 90 cents per share, up from 87 cents per share.

TD stated it earned $2.89 billion or $1.49 per diluted share for the quarter ended Oct. 31, down from a revenue of $6.67 billion or $3.62 per diluted share a 12 months earlier. It raised its dividend to $1.02 per share, up from 96 cents.

The Canadian Press

Learn the total tales: RBC beats expectations; CIBC beats expectations; TD cuts hundreds of jobs as earnings miss

Commercial 11

Article content material

Inventory markets earlier than the opening bell

World shares have been principally increased Thursday forward of an replace on United States client inflation and a gathering of oil producers in Vienna.

U.S. futures rose and oil costs additionally superior.

Germany’s DAX edged 0.1 per cent increased to 16,189.89 and the CAC 40 in Paris additionally gained 0.1 per cent to 7,277.03. Britain’s FTSE 100 picked up 0.3 per cent to 7,448.08. The long run for the S&P 500 rose 0.1 per cent and that for the Dow Jones industrial common was up 0.4 per cent.

The S&P/TSX composite index closed up 79.43 factors at 20,116.20 on Wednesday.

The Related Press

What to observe immediately

Statistics Canada will launch gross home product numbers for the third quarter this morning. We’ll additionally get the September survey of employment, payroll and hours. In the USA, count on the discharge of preliminary jobless claims for the week of Nov. 25, private earnings and consumption knowledge for October, the Chicago PMI for November and pending residence gross sales for October.

Extra massive financial institution earnings are on faucet immediately, too, with studies from Royal Financial institution of Canada, Toronto-Dominion Financial institution and Canadian Imperial Financial institution of Commerce.

Commercial 12

Article content material

Labour Minister Seamus O’Regan takes half in a dialog with Empire Membership of Canada chair Sal Rabbani. The dialogue might be centered on an financial replace on the state of labour relations in Canada, and the way enterprise, labour and authorities can work collectively to handle structural modifications within the labour market and develop the financial system amidst inflation, vitality transition, automation and different challenges.

Nate Horner, Alberta’s minister of finance, will present an replace on the province’s funds and financial system.

Associated Tales

-

Why some newcomers are leaving Canada

-

5 Canadian shares which have been full disasters

Want a refresher on yesterday’s prime headlines? Get caught up right here.

Extra reporting by The Canadian Press, Related Press and Bloomberg

Bookmark our web site and help our journalism: Don’t miss the enterprise information it is advisable to know — add financialpost.com to your bookmarks and join our newsletters right here.

Article content material