The newest enterprise information because it occurs

Article content material

Prime headlines

Article content material

4:34 p.m.

Market shut: TSX beneficial properties greater than 200 factors as U.S. inventory markets additionally rise

Commercial 2

Article content material

Canada’s most important inventory index gained greater than 200 factors on broad-based energy led by base metals, industrials and telecom shares, whereas U.S. markets additionally rose.

The S&P/TSX composite index closed up 216.58 factors at 20,452.87.

In New York, the Dow Jones industrial common was up 294.61 factors at 36,245.50.The S&P 500 index was up 26.83 factors at 4,594.63, whereas the Nasdaq composite was up 78.81 factors at 14,305.03.

The Canadian greenback traded for 74.04 cents U.S. in contrast with 73.63 cents U.S. on Thursday.

The January crude oil contract was down US$1.89 at US$74.07 per barrel and the January pure gasoline contract was up one cent at US$2.81 per mmBTU.

The February gold contract was up US$32.50 at US$2,089.70 an oz and the March copper contract was up eight cents at US$3.93 a pound.

The Canadian Press

3:47 p.m.

Enbridge wins fee log off on Nice Lakes Line 5 tunnel

Enbridge Inc.‘s proposed pipeline tunnel below Michigan’s Straits of Mackinac was permitted by a key fee, a win for the corporate amid a long-running dispute with the state’s governor over the conduit’s future.

Commercial 3

Article content material

The Michigan Public Service Fee permitted the corporate’s utility to construct a tunnel below the channel that connects Lakes Michigan and Huron. The tunnel would home the corporate’s Line 5 oil pipeline, which at the moment rests on the lakebed. Enbridge argues the tunnel will cut back dangers of an oil spill however Governor Gretchen Whitmer issued an order to close the road.

Enbridge and Whitmer have been enmeshed in a courtroom battle for years and the dispute has roiled relations between the USA and Canada, which depends on Line 5 to produce refineries in Quebec and Ontario.

“We’re prepared to start work on this mission,” Enbridge mentioned in a launch. “The one factor standing in the way in which of finding a substitute part of Line 5 into the tunnel is a call on our allow utility by the U.S. Military Corps of Engineers.”

Bloomberg

2 p.m.

Telecoms defy forecasts by spending billions much less in spectrum public sale

Canadian wi-fi firms spent about $2.2 billion in a sale of wireless-spectrum licences, considerably lower than analysts had forecast, because the sector grapples with excessive ranges of debt.

Article content material

Commercial 4

Article content material

A lot of the spending was executed by the three firms that dominate the trade. Telus Corp. spent essentially the most at $620 million, adopted by BCE Inc. at $518 million and Rogers Communications Inc. at $475 million.

The large wi-fi firms surprised traders two years in the past by collectively spending $8.9 billion in a sale of wi-fi licences to construct out 5G companies. This time, there was extra spectrum out there and a unique set of public sale guidelines, which “allowed for much extra self-discipline and subdued bidding” throughout the three-week public sale, Nationwide Financial institution of Canada analyst Adam Shine mentioned in a word.

Shine had estimated the trade would spend a minimum of $3.1 billion within the public sale of 3800 megahertz spectrum. BMO Capital Markets analyst Tim Casey had forecast spending of $4 billion to $4.5 billion, and another analysts have been even larger.

Rogers, Canada’s largest wi-fi supplier by variety of subscribers, has taken on larger leverage with the acquisition of rival Shaw Communications Inc. earlier this yr. BCE, the nation’s greatest telecommunications supplier, has piled on vital quantities of latest debt lately to spend closely on constructing sooner fibre-optic networks for dwelling and enterprise companies. The corporate’s curiosity expense was up 30 per cent within the first 9 months of the yr, to $1.08 billion.

Commercial 5

Article content material

Rogers shares rose 2.3 per cent, whereas Telus was up 2.4 per cent and BCE gained 0.9 per cent as of 11:06 a.m. in Toronto. An index of Canadian telecom shares is down about seven per cent thus far this yr.

Bloomberg

12:24 p.m.

Noon markets: Traders greet December with beneficial properties on Wall Avenue, Toronto

United States Treasuries and shares pushed larger, with the market boosting bets on charge cuts subsequent yr after Jerome Powell signalled the Federal Reserve will presumably keep put this month — whilst he retained the choice to hike additional.

Two-year yields dropped 9 foundation factors to beneath 4.6 per cent. The S&P 500 traded close to session highs. “Having come thus far so shortly, the FOMC is transferring ahead fastidiously, because the dangers of under- and over-tightening have gotten extra balanced,” Powell mentioned at Spelman Faculty in Atlanta. The U.S. greenback retreated. Fed swaps priced in further easing by the top of 2024. Merchants count on the efficient Fed funds charge will fall to about 4.07 per cent from 5.33 per cent at the moment.

“Powell tried to push again, however that lasted solely ‘just a few seconds’ in Treasuries,” mentioned Peter Boockvar, writer of the Boock Report. “Whereas the market thinks it’s as straightforward because the Fed is completed and cuts are coming subsequent yr, the speech he’s giving right now is purposely meant, I consider, to attempt to preserve the markets offside. I say ‘considerably’ as a result of it wasn’t forceful and the markets aren’t being swayed.”

Commercial 6

Article content material

On Wall Avenue, the S&P 500 was up 0.51 per cent at 4,591.04. The Dow Jones Industrial Common was up 0.68 per cent at 36,197.87 whereas the Nasdaq composite was up 0.39 per cent at 14,281.95.

In Toronto, the S&P/TSX composite index rose 0.66 per cent to twenty,369.83, buoyed by energy in base metallic, power and industrial shares.

The Canadian Press, Bloomberg

11:54 a.m.

Court docket rulings pressure rethink of oil, gasoline emissions cap, minister says

Setting Minister Steven Guilbeault says two current courtroom selections placing down some federal surroundings insurance policies delayed plans to implement a cap on emissions from oil and gasoline manufacturing.

Guilbeault is in Dubai for the annual international local weather pact talks happening over the subsequent two weeks.

Guilbeault mentioned earlier this week that the framework outlining the Liberals’ long-promised oil and gasoline cap is prone to be printed throughout COP28.

Alberta Premier Danielle Smith, who will meet with Guilbeault in Dubai throughout the occasion, has promised to battle any emissions cap on oil and gasoline as an intrusion on provincial jurisdiction over pure assets.

Commercial 7

Article content material

Guilbeault says two current courtroom selections that touched on federal and provincial jurisdiction did pressure him to return and ensure the proposed cap gained’t intrude on that jurisdiction.

One choice overturned components of the federal environmental assessment course of and one other struck down the designation of manufactured plastic objects as being poisonous.

The Canadian Press

11:15 a.m.

First Quantum begins arbitration course of to guard rights at Cobre Panama mine

First Quantum Minerals Ltd. says it has began arbitration proceedings to guard its rights at its Cobre Panama mine which has been the topic of environmental protests.

The Canadian miner says its Minera Panama SA subsidiary has began the motion earlier than the Worldwide Court docket of Arbitration to guard its rights below a concession settlement with the federal government in Panama agreed to earlier this yr.

First Quantum suspended operations at its Cobre Panama mine earlier this week after Panama’s Supreme Court docket dominated unanimously Tuesday {that a} 20-year concession settlement protecting the copper mine was unconstitutional.

Commercial 8

Article content material

The corporate says it’s looking for further particulars in respect of the ruling and its implications.

The mine was briefly closed final yr when talks between the corporate and authorities broke down over funds the federal government needed, however the two sides reached a deal in March.

The settlement, which was given last approval Oct. 20, has confronted widespread protests together with a blockade of small boats that prevented provides from reaching the mine.

The Canadian Press

9:45 a.m.

Inventory markets take a breather after November rally

North American inventory markets have been combined in early buying and selling Friday after closing out one of the best month of the yr.

The S&P 500 was down 0.15 per cent, whereas the Dow Jones industrial common was up 0.09 per cent simply after the open.

The S&P/TSX composite index was within the pink, down 0.1 per cent.

Monetary Publish, The Related Press

8:30 a.m.

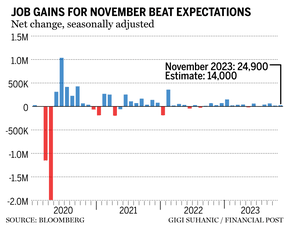

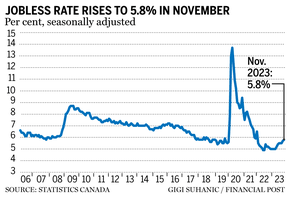

Canada provides 25,000 jobs in November, unemployment charge rises to five.8%

The Canadian financial system added 25,000 jobs in November, whereas the unemployment charge rose to five.8 per cent, Statistics Canada mentioned Friday.

The unemployment charge was 5.7 per cent in October.

Commercial 9

Article content material

Manufacturing and building had the most important beneficial properties in employment, whereas essentially the most jobs have been shed in wholesale and retail commerce in addition to finance, insurance coverage, actual property, rental and leasing.

As labour market circumstances weaken, unemployed individuals final month have been extra prone to have been laid off in contrast with a yr in the past, Statistics Canada mentioned.

The softer job market circumstances come as excessive rates of interest weigh on financial progress and a ballooning inhabitants provides to the variety of individuals in search of work.

Regardless of these developments, nonetheless, common hourly wages continued to develop shortly — rising 4.8 per cent from a yr in the past — as employees search compensation for top inflation.

Monetary Publish, The Canadian Press

Extra: Canada beneficial properties 25,000 jobs however unemployment charge ticks up

7:45 a.m.

BMO, Nationwide Financial institution elevate dividend funds

Financial institution of Montreal and Nationwide Financial institution of Canada each raised their quarterly dividend funds in combined earnings studies on Friday.

BMO can pay a quarterly dividend of $1.51 a share, up from $1.47 per share. Revenue fell on the financial institution, with internet revenue amounting to almost $1.62 billion or $2.06 per diluted share for the quarter ended Oct. 31, down from $4.48 billion or $6.51 per diluted share a yr earlier.

Commercial 10

Article content material

Nationwide Financial institution can be elevating its dividend, because it reported an increase in income from a yr in the past. Its quarterly dividend to shareholders rises to $1.06 per share, up from $1.02. The financial institution mentioned it earned $768 million or $2.14 per diluted share for the quarter ended Oct. 31, up from $738 million or $2.08 per diluted share a yr earlier.

The banks be a part of Royal Financial institution of Canada, Toronto-Dominion Financial institution and Canadian Imperial Financial institution of Commerce in elevating dividend funds this week.

The Canadian Press

Extra: Are Canada’s huge banks simply enjoying it protected or is there extra bother forward?

7:30 a.m.

First Quantum dangers covenant breach, value cuts if Panama shuts key copper mine

First Quantum Minerals Ltd. could possibly be compelled to sluggish spending subsequent yr and face a possible breach of debt covenants if Panama follows by way of on plans to shut a copper mine that generated roughly US$1 billion in revenue final yr.

The Cobre Panama mine has been the Canadian firm’s high cash maker since its 2019 opening and was anticipated to account for nearly half of worldwide gross sales subsequent yr. Now, after the federal government introduced plans to shutter the US$10-billion operation, First Quantum could must trim spending elsewhere or promote property in an effort to stay in compliance with lender agreements.

Commercial 11

Article content material

The corporate is dealing with an estimated US$625 million in debt maturities subsequent yr and one other US$1.8 billion in 2025, based on Citigroup Inc. With out Cobre Panama’s income, the corporate’s debt covenants could be examined in 2024, First Quantum chief monetary officer Ryan MacWilliam advised a convention hosted by Financial institution of Nova Scotia on Nov. 29. The financial institution mentioned in a analysis word that at present copper costs and with out the mine, it anticipated a covenant breach within the fourth quarter of subsequent yr. First Quantum shares dropped 10 per cent to a three-year low.

It’s as-yet unclear how severe the danger is of a everlasting closure of Cobre Panama. That mentioned, First Quantum would put up destructive free money movement of about US$300 million 1 / 4 with out it — a minimum of initially, Citigroup analysts wrote in a word to purchasers.

Jacob Lorinc and James Attwood, Bloomberg

Learn the complete story right here.

Inventory markets earlier than the opening bell

World shares have been combined on Friday after Wall Avenue closed out its greatest month of the yr with huge beneficial properties in November.

Germany’s DAX rose 0.6 per cent to 16,309.89 and the CAC 40 in Paris added 0.5 per cent to $7,348.88. Britain’s FTSE 100 was up 0.8 per cent at 7,512.94.

Commercial 12

Article content material

The longer term for the S&P 500 edged 0.1 per cent decrease whereas that for the Dow Jones industrial common gained 0.1 per cent.

The S&P/TSX composite index closed up 120.09 factors at 20,236.29 on Thursday.

The Related Press

What to observe right now

Statistics Canada will launch the employment report for November this morning. The S&P International Manufacturing PMI can be set for launch.

Financial institution of Montreal and Nationwide Financial institution of Canada will report earnings right now.

Trades will probably be looking forward to rate of interest clues from United States Federal Reserve chair Jerome Powell, who is about to take part in a hearth chat at a school in Atlanta.

Setting and Local weather Change Canada will launch its forecast for the upcoming winter season.

Associated Tales

-

Canada dodges technical recession however ‘struggles to develop’

-

International pension counts towards revenue, however taxpayer finds one other catch

Want a refresher on yesterday’s high headlines? Get caught up right here.

Extra reporting by The Canadian Press, Related Press and Bloomberg

Bookmark our web site and help our journalism: Don’t miss the enterprise information that you must know — add financialpost.com to your bookmarks and join our newsletters right here.

Article content material