Actual property not out of the woods but, warn economists

Article content material

Article content material

Canada’s greatest actual property market “woke from its slumber” to finish the yr, with residence gross sales spiking 21 per cent in December from the month earlier than.

The surge within the Better Toronto Space, probably pushed by a dip in bond and mortgage charges, dropped at thoughts the rally seen final spring when the Financial institution of Canada first paused rates of interest, and led some to foretell a rebound is on its method.

Commercial 2

Article content material

“It’s comprehensible that folks would see these indicators and anticipate a redux of frothy market situations in The Large Smoke,” stated Marc Desormeaux, principal economist at Desjardins.

“However a more in-depth take a look at the state of affairs exhibits extra warning is warranted.”

Gross sales weren’t almost as sturdy because the headline implies if you look deeper into the numbers, Desormeaux stated in a observe Friday.

Seasonal changes to Toronto residence gross sales have traditionally been bigger in December, the slowest month of the yr, and so the achieve ought to be taken “with a grain of salt,” he stated.

Gross sales on this market nonetheless stay effectively under ranges seen within the decade earlier than the pandemic and are even weaker on a per capita foundation.

Most necessary, nonetheless, is although the extremely rate-sensitive housing market has responded to rising borrowing prices, the broader financial system has not but felt the complete impression, he stated.

Desjardins believes what is going to drive the housing market in months to return is the well being of the labour market, and in Ontario, particularly, that appears much less promising.

The economists predict that Canada’s GDP will fall and unemployment will rise within the first half of this yr, because the impact of upper rates of interest continues to impression the financial system.

Article content material

Commercial 3

Article content material

“We additionally anticipate Ontario to really feel that downturn extra acutely than most provinces,” stated Desormeaux.

The province has skilled job losses for 3 straight months and the job emptiness fee is falling extra shortly in Ontario than elsewhere in Canada.

As rates of interest come down later this yr, Toronto’s housing market can be topic to each tailwinds and headwinds, stated Desormeaux.

On the plus facet, a wave of millennials, now of the age to purchase their very own properties, will help housing demand. The Financial institution of Canada’s newest shopper survey confirmed that an growing share of renters intend to purchase a house within the subsequent 12 months.

“However many households additionally indicated that regardless of the potential for some borrowing price aid this yr, earlier rate of interest hikes had solely begun to impression their monetary place,” stated Desormeaux.

The December rally in Toronto’s housing market stays a “double-edged sword” as a result of it is going to additional restrict affordability, stated the economists.

And Desjardins’ personal research have proven that the variety of younger individuals shifting out of higher-priced cities like Toronto is rising.

Commercial 4

Article content material

“As we begin 2024, it’s too quickly to inform whether or not Canada’s largest housing market is headed for a resurgence or a relapse,” stated Desormeaux.

“What is evident at this stage is that affordability points are nonetheless very a lot on the minds of Canadians, and certain can be for years to return.”

Economists on the Royal Financial institution of Canada additionally warning in opposition to studying an excessive amount of into the year-end rally.

“Whether or not the underside has been reached or not, Canada’s housing market stays delicate in most areas at this stage with many potential patrons struggling to afford a purchase order,” stated economists Robert Hogue and Rachel Battaglia.

RBC expects that softness to proceed by means of the primary half of the yr with a market restoration coming within the second half as Financial institution of Canada rate of interest cuts accumulate.

“That stated, any worth restoration can be restrained by lingering affordability points,” they stated.

_____________________________________________________________________

Was this text forwarded to you? Enroll right here to get it delivered to your inbox.

_____________________________________________________________________

Commercial 5

Article content material

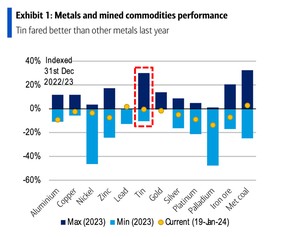

Right here’s a metallic you don’t hear about too usually — tin. But the “forgotten commodity” has fared higher than most different industrial metals in 2023, rallying as much as 30 per cent through the yr to a excessive of US$32,262 a ton, says BofA International Analysis’s commodities workforce.

In reality, tin costs have been trending greater since 2000, when it was buying and selling at round $4,000 a ton.

Analysts imagine there are two causes for the value surge. Tin is taken into account a MIFT, a metallic necessary for future applied sciences, and no “blue chip” miner has taken a strategic curiosity within the metallic, which has saved manufacturing down.

- A Vancouver court docket will resolve right now whether or not to approve a settlement of as much as $14.4 million that Apple has provided after being accused of getting efficiency mitigation options in its iOS software program and defects in some iPhones.

- The Canadian Membership of Ottawa hosts an occasion in Ottawa entitled: Innovation, Sustainability, and the Way forward for Work.

- The Canadian Chamber of Commerce hosts a web-based occasion entitled “The State of Small Companies in Canada: Navigating Click on-and-Mortar Alternatives.”

Commercial 6

Article content material

The Toronto Inventory Trade solely has just a few massive expertise firms — notably Shopify Inc., Constellation Software program Inc. and CGI Inc. — however the sector is of rising significance to each Canada’s present and future financial system in addition to buyers. Fairness analyst Sharon Wang outlines what buyers ought to search for on this market’s small-to-mid-cap universe. Get extra at FP Investing

Beneficial from Editorial

-

Coming recession can be a story of housing versus commodities

-

Canadians are displaying the pressure of their traditionally excessive debt

At present’s Posthaste was written by Pamela Heaven, @pamheaven, with further reporting from The Canadian Press, Thomson Reuters and Bloomberg.

Have a narrative concept, pitch, embargoed report, or a suggestion for this text? E mail us at posthaste@postmedia.com, or hit reply to ship us a observe.

Bookmark our web site and help our journalism: Don’t miss the enterprise information it is advisable know — add financialpost.com to your bookmarks and join our newsletters right here.

Article content material