How arduous every province is hit will rely on their relative exposures to those markets, says economist

Article content material

How arduous every province is hit by this yr’s anticipated recession will rely on their relative exposures to the housing and commodities markets, says one economist.

Article content material

“Housing and different curiosity‑charge‑delicate sectors will really feel the approaching financial downturn most acutely, whereas commodity producers shall be much less weak,” Marc Desormeaux, principal economist at Desjardins Group, mentioned in a report on Jan. 23. “We expect this distinction will turn out to be starker in 2024.”

Commercial 2

Article content material

Montreal-based Desormeaux mentioned Ontario and British Columbia — house to Canada’s two largest housing markets — will take the biggest financial hit, with every contracting 0.1 per cent in 2024, in contrast with development in commodity-focused Alberta, Saskatchewan and Newfoundland and Labrador of 0.9 per cent, 0.7 per cent and 1.7 per cent, respectively.

Actual property accounted for about 20 per cent of whole gross home product, in accordance with Statistics Canada, however the sector has been struggling beneath the burden of upper rates of interest.

House gross sales fell 11.2 per cent in 2023 from 2022, in accordance with the Canadian Actual Property Affiliation, as larger rates of interest lower into exercise. CREA in its most up-to-date housing report mentioned “value declines have been predominantly situated in Ontario markets … and to a lesser extent British Columbia.”

With actual property exercise accounting for nearly 13 per cent GDP in Ontario and nearly 20 per cent in B.C., it’s no marvel Desormeaux predicts a harder street forward for these provinces till rates of interest begin to fall — one thing economists are forecasting for the center of this yr.

Article content material

Commercial 3

Article content material

In the meantime, the sturdy outlook for commodities, significantly oil, potash and uranium, are anticipated to offer financial cushions for Alberta, Saskatchewan and Newfoundland and Labrador.

Toronto house gross sales rose on the finish of the yr on account of decrease mortgage charges, however that “might be a double-edged sword,” Desormeaux mentioned, because it augurs worsening affordability in a province with the largest scarcity of housing.

Moreover, housing begins are anticipated to fall in 2024, family consumption is slumping — “uncommon exterior a recession” — and the financial savings charge is declining, so varied financial headwinds are constructing.

However the economist is most fearful concerning the results of excessive charges in B.C.

“B.C. stays Canada’s most housing‑oriented provincial financial system, and its households are probably the most indebted,” he mentioned, including {that a} struggling labour market and weakening retail gross sales are exhibiting indicators of the pressure from larger rates of interest.

Desormeaux’s outlook is sunnier for Alberta. The commodity-dependent financial system is stronger-than-expected development primarily based on growing oil output. Desjardins is forecasting a mean oil value of US$80 per barrel with the almost completed Trans Mountain pipeline growth anticipated to “assist Alberta costs.”

Commercial 4

Article content material

Commodities may also clean issues out in Saskatchewan and Newfoundland and Labrador.

Uranium manufacturing in Saskatchewan is predicted to maintain rising and oil manufacturing will outpace 2023 ranges. A $7.5-billion funding in BHP Group Ltd.’s Jansen potash mine can be anticipated to spice up the financial system. In Newfoundland and Labrador, the place oil manufacturing accounts for 20 per cent of output, Suncor Power Inc.’s Terra Nova offshore oilfield has returned to manufacturing after being out of fee since 2019.

However the anticipated good occasions in these three provinces don’t imply Canada will keep away from an financial contraction.

“We additionally nonetheless assume nearly all areas of Canada will expertise slowdowns in 2024 in response to sharply larger borrowing prices and weaker expansions amongst our buying and selling companions,” Desormeaux mentioned. “Later this yr, charge cuts ought to assist the financial system rebound.”

Join right here to get Posthaste delivered to your inbox.

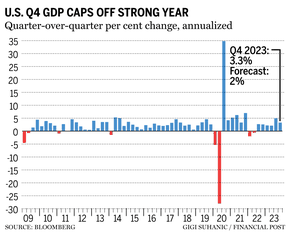

America financial system’s fourth-quarter development trounced forecasts as cooling inflation fuelled client spending, capping a surprisingly sturdy yr that defied recession calls.

Commercial 5

Article content material

Gross home product elevated at a 3.3 per cent annualized charge, in accordance with the federal government’s preliminary estimate out Thursday. For all of 2023, the financial system expanded 2.5 per cent.

The financial system’s major development engine — private spending — rose at a 2.8 per cent charge. Enterprise funding and housing additionally helped gasoline the larger-than-expected advance final quarter. — Bloomberg

Learn the total story right here

- The thirty fifth Annual Financial Outlook Discussion board, introduced by Scotiabank, shall be held in Vancouver with a give attention to what companies within the Higher Vancouver area can count on from the native and nationwide financial system within the yr forward.

- The federal Division of Finance publishes monetary outcomes for November 2023.

- At the moment’s information: United States private consumption expenditure index, pending house gross sales

- Earnings: American Specific Co., Colgate-Palmolive Co., Weyerhaeuser Co.

Get all of at present’s prime breaking tales as they occur with the Monetary Publish’s stay information weblog, highlighting the enterprise headlines it’s essential to know at a look.

Commercial 6

Article content material

The month of January, and, consequently, the brand new tax yr, creates a recent planning alternative for post-secondary college students to remain one step forward of the taxman in 2024. That is significantly true relating to managing registered training financial savings plan (RESP) withdrawals to reduce taxes. Learn Jamie Golombek’s recommendation right here.

* * *

Are you fearful about having sufficient for retirement? Do it’s essential to regulate your portfolio? Are you questioning how one can make ends meet? Drop us a line at aholloway@postmedia.com together with your contact information and the final gist of your downside and we’ll attempt to discover some specialists that can assist you out whereas writing a Household Finance story about it (we’ll preserve your title out of it, in fact). In case you have an easier query, the crack workforce at FP Solutions led by Julie Cazzin or one in all our columnists can provide it a shot.

Advisable from Editorial

-

Financial institution of Canada holds rate of interest at 5%, however indicators shift

-

5 methods Canada can get inflation down with out elevating rates of interest

At the moment’s Posthaste was written by Gigi Suhanic, with extra reporting from The Canadian Press and Bloomberg.

Have a narrative concept, pitch, embargoed report, or a suggestion for this article? E mail us at posthaste@postmedia.com, or hit reply to ship us a word.

Article content material