The newest enterprise information because it occurs

Article content material

At this time’s headlines

Commercial 2

Article content material

Article content material

Prime story

Federal authorities’s deficit climbs to $19.1 billion from $3.6 billion final 12 months

The federal authorities posted a deficit of $19.1 billion for the primary eight months of its 2023-24 fiscal 12 months.

The consequence for the April-to-November interval in contrast with a deficit of almost $3.6 billion reported for a similar stretch of its 2022-23 fiscal 12 months.

Authorities revenues for the eight-month interval totalled $281.8 billion, up 2.6 per cent from $274.7 billion in the identical interval a 12 months earlier.

Program bills, excluding internet actuarial losses, for the April-to-November interval totalled almost $264.9 billion, up 6.3 per cent from almost $249.2 billion.

Greater rates of interest pushed public debt expenses up 37.7 per cent to 31.0 billion from $22.5 billion a 12 months earlier.

Web actuarial losses totalled $5.0 billion in contrast with almost $6.6 billion in the identical interval final 12 months.

— The Canadian Press

4:31 p.m.

Market shut: TSX edges increased as U.S. markets blended

Canada’s primary inventory index eked out a acquire, whereas U.S. markets ended the day blended as tech pulled equities decrease.

Commercial 3

Article content material

The S&P/TSX composite index closed up 23.74 factors at 21,125.28.

In New York, the Dow Jones industrial common was up 60.30 factors at 38,109.43. The S&P 500 index was down 3.19 factors at 4,890.97, whereas the Nasdaq composite was down 55.13 factors at 15,455.36.

The Canadian greenback traded for 74.35 cents U.S. in contrast with 74.10 cents U.S. on Thursday.

The March crude oil contract was up 65 cents at US$78.01 per barrel and the March pure gasoline contract was down half a penny at US$2.18 per mmBTU.

The February gold contract was down 50 cents at US$2,017.30 an oz and the March copper contract was down two cents at US$3.85 a pound.

The Canadian Press

2:05 p.m.

Courtroom denies environmental group injunction towards Northvolt EV battery plant

A Quebec Superior Courtroom decide has refused to grant an injunction to halt tree slicing and different preparatory work on the web site of a future electrical automobile facility east of Montreal.

Justice David Collier stated Friday that the environmental group and the residents who have been searching for the order didn’t meet the excessive bar of proof to indicate the province’s Atmosphere Division and a municipality acted unreasonably in granting Northvolt AB a allow.

Article content material

Commercial 4

Article content material

The Centre quebecois du droit de l’environnement had sought an injunction suspending work on the 170-hectare web site, arguing that the province allowed work to start with out correct evaluation of the affect on the world’s biodiversity.

In addition they argued that the city of St-Basile-le-Grand — the place the ability is to be partly situated — gave a allow to chop down timber primarily based on an “unreasonable interpretation” of guidelines defending wetlands.

Collier wrote in his resolution that governments have vast discretion with regards to making choices, and the courtroom can solely invalidate them in very restricted circumstances.

He stated the plaintiffs did not show that the province was abdicating its accountability or giving Northvolt a “clean cheque” to construct the manufacturing unit and not using a plan to remediate the environmental impacts.

— The Canadian Press

1:46 p.m.

Rogers Sugar reaches tentative take care of placing Vancouver refinery employees

Rogers Sugar Inc. says it has reached a tentative settlement with the union representing employees at its Vancouver refinery.

Particulars of the tentative deal weren’t instantly out there.

Commercial 5

Article content material

The employees are represented by the Public and Non-public Employees of Canada.

The corporate says a ratification vote shall be held subsequent week.

The Vancouver refinery employs about 140 unionized employees.

The employees have been on strike since Sept. 28, 2023.

The Canadian Press

1:17 p.m.

Tamara Vrooman leaves position as chair of Canada Infrastructure Financial institution

Tamara Vrooman is leaving her position as chair of the Canada Infrastructure Financial institution.

Federal Infrastructure Minister Sean Fraser says Vrooman’s departure after three years within the job takes impact tomorrow.

Jane Chook, a member of the CIB board of administrators, has been named interim chair till a everlasting one is appointed.

Vrooman turned chair of the Canada Infrastructure Financial institution in January 2021.

She is chief govt of the Vancouver Airport Authority.

Fraser thanked Vrooman for her work on the board and wished her one of the best as she continues her position on the Vancouver airport.

The Canadian Press

1:07 p.m.

BlackBerry inventory hits 20-year low after personal debt providing

BlackBerry Ltd. shares hit its lowest level in about 20 years this week after the software program firm supplied convertible senior notes in a push to chop down on its debt.

Commercial 6

Article content material

As soon as a Canadian tech darling, the corporate’s Toronto-listed shares fell as a lot as 20 per cent on Wednesday to $3.94, closing the session at its lowest level since Could 2003. Within the late 2000s, BlackBerry was one the most important gamers within the international smartphone market with a peak market worth of over $80 billion. Now it’s price about $2.3 billion.

BlackBerry upsized the convertible observe providing to US$175 million from US$160 million on Thursday, and priced its five-year convertible notes at a 3 per cent coupon and US$3.88 conversion worth. The corporate stated in a press launch that it plans to make use of internet proceeds from the providing to fund reimbursement or repurchase of its excellent US$150 million current debentures due Feb. 15 and the rest for normal company functions.

“The pricing seems higher than feared,” RBC Dominion Securities analyst Paul Treiber wrote in a observe.

The providing comes a month after the corporate’s newly minted chief govt John Giamatteo backed away from plans to spin off its web of issues enterprise, reversing plans made by John Chen, who held the chief govt helm for almost a decade.

Commercial 7

Article content material

Bloomberg

12:35 p.m.

Canadian vitality producers dismayed by Biden’s transfer to pause U.S. LNG approvals

Canada’s vitality trade is reacting with dismay to U.S. president Joe Biden’s transfer to pause approvals of recent liquefied pure gasoline (LNG) export terminals in that nation.

Biden’s resolution is being seen as a win by environmentalists who concern a rise in North American LNG exports will lock in greenhouse gasoline emissions for the long-term and make it unimaginable for international locations to fulfill their local weather commitments.

However the Canadian Affiliation of Petroleum Producers stated Friday it’s upset by the choice, including it sees LNG as a lower-emission supply of safe vitality that may assist international locations get off coal.

The trade group added that LNG amenities on the U.S. Gulf Coast additionally provide Canadian pure gasoline producers a possibility to export their product globally.

The U.S. is the most important exporter of LNG on the planet, whereas Canada doesn’t but have its personal LNG export capability.

Canadian pure gasoline producers have been eagerly anticipating the startup of the huge LNG Canada export terminal being constructed close to Kitimat, B.C., which is 90 per cent full and anticipated to be operational later this 12 months.

Commercial 8

Article content material

Learn the complete story.

The Canadian Press

Midday

Noon markets: Expertise shares enhance TSX

Energy in know-how shares helped maintain Canada’s primary inventory index within the inexperienced in late-morning buying and selling, whereas inventory markets on Wall Avenue additionally moved increased.

The S&P/TSX composite index was up 0.03 per cent at 21,106.43.

In New York, the Dow Jones industrial common was up 0.31 per cent at 38,168.79. The S&P 500 index was up 0.18 per cent at 4,902.91, whereas the Nasdaq composite was up 0.15 per cent at 15,533.54.

The Canadian greenback traded for 74.30 cents US in contrast with 74.10 cents US on Thursday.

The March crude oil contract was down 1.27 per cent to US$76.38 per barrel and the March pure gasoline contract was down six cents at US$2.12 per mmBTU.

The February gold contract up 0.02 per cent at US$2,018.20 an oz and the March copper contract up lower than a penny at US$3.87 a pound.

The Canadian Press

11:28 a.m.

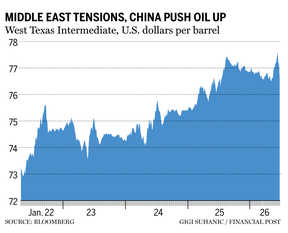

Oil set to rise 5% this week

Oil headed for the most important weekly acquire since October as decrease United States stockpiles and the prospect of extra authorities stimulus in China helped propel crude out of the vary it had been caught in for months.

Commercial 9

Article content material

West Texas Intermediate edged above US$77 a barrel on Friday, and was on tempo for a weekly acquire of greater than 5 per cent, its greatest because the week following the beginning of the Israel-Hamas struggle. Crude jumped on Thursday in a rally ignited by constructive basic information and prolonged by buying and selling algorithms.

Crude’s advance has been underpinned by elevated tensions within the Center East, with the U.S. placing Iran-backed Houthi rebels in Yemen to drive them to halt assaults on industrial transport. Elsewhere, drone assaults on refineries in Russia endangered crude flows because the struggle in Ukraine drags on.

Oil has gained greater than eight per cent in January, with further assist from an unexpectedly massive drawdown in U.S. inventories and efforts by Chinese language policymakers to shore up the economic system. Nonetheless, many merchants stay cautious given prospects for sturdy provides from non-OPEC producers, in addition to slower demand development in main importers, together with India.

— Bloomberg

10:06 a.m.

Wall Avenue poised to shut out one other profitable week

U.S. shares are hanging close to their file heights Friday as Wall Avenue heads towards the shut of its twelfth profitable week within the final 13.

Commercial 10

Article content material

The S&P 500 was down 0.09 per cent in early buying and selling after setting a file excessive for 5 straight days. The Dow Jones Industrial Common was up 0.1 per cent, and the Nasdaq composite was 0.31 per cent decrease.

Intel Corp.’s drop of 11.2 per cent was dragging available on the market after its forecasts for income and revenue for the beginning of 2024 fell wanting Wall Avenue’s estimates.

Visa additionally sank, down 1.6 per cent, regardless of reporting higher outcomes than anticipated. Analysts referred to as the figures stable however highlighted how the corporate described some slowing traits for January to this point.

The U.S. inventory market is however closing out one other profitable week as stories maintain suggesting inflation is cooling whereas the economic system continues to energy increased. The sudden backdrop has hopes excessive that Wall Avenue’s dream state of affairs can come true: one the place a resilient economic system drives income increased for corporations, whereas inflation moderates sufficient to persuade america Federal Reserve to chop rates of interest many instances this 12 months.

The newest report on Friday confirmed the measure of inflation the Fed prefers to make use of behaved nearly precisely as anticipated in December. General inflation by that measure was 2.6 per cent through the month, matching November’s price.

Commercial 11

Article content material

The Fed pays extra consideration to the inflation determine after ignoring costs for meals and gas, which may zigzag sharply month to month. That determine cooled to 2.9 per cent from 3.2 per cent and was a bit higher than economists anticipated.

In Canada, the S&P/TSX composite index was up 0.07 per cent on energy in vitality and knowledge know-how shares.

— The Related Press, Monetary Put up

7:30 a.m.

Canada, U.Ok. blame one another as commerce talks collapse

The UK paused talks to strike a free-trade take care of Canada, with either side accusing the opposite of obstructing progress.

The 2 international locations have been negotiating for nearly two years on changing an interim deal put in place following Britain’s departure from the European Union. The breakdown in talks successfully leaves the U.Ok. susceptible to being in a worse place than it was as a member of the bloc with regards to Canada commerce.

A serious sticking level was on agriculture. The U.Ok. was pushing to increase a brief association — which expired Dec. 31 — permitting exports of British cheese to Canada underneath low tariffs, just like these loved by E.U. members. Canada, for its half, had hoped to safe U.Ok. entry for its beef and pork.

Commercial 12

Article content material

However these don’t at the moment meet British regulatory requirements, and Prime Minister Rishi Sunak’s administration has come underneath intense stress from U.Ok. farmers to not permit, particularly, hormone-treated beef into the nation.

“We needed to take a powerful line on this,” Minette Batters, president of the Nationwide Farmers’ Union of England and Wales, informed the BBC. “It will result in a two-tier meals market on this nation. There isn’t any have to compromise on it.”

Explaining the choice to stall talks, a U.Ok. authorities spokesperson stated late Jan. 25 Britain will solely negotiate commerce offers that “ship” for its folks.

“We stay open to restoring talks with Canada sooner or later to construct a stronger buying and selling relationship that advantages companies and shoppers on each side of the Atlantic,” the spokesperson stated in a publish printed by Susannah Goshko, British Excessive Commissioner to Canada, on X, previously Twitter.

The U.Ok. is Canada’s third-largest, single-country buying and selling associate at over $46 billion a 12 months, in response to the Canadian authorities. The U.Ok. ranks Canada as its 18th-largest buying and selling associate.

Commercial 13

Article content material

Laura Dhillon Kane and Brian Platt, Bloomberg

Learn the complete story right here.

7:30 a.m.

Inventory markets earlier than the opening bell

European shares rose on Friday, lifted by a raft of forecast-beating earnings and expectations that euro-area rates of interest will begin falling from April.

The Stoxx 600 index rose 0.9 per cent.

Contracts on the S&P 500 and the Nasdaq 100, then again, signalled a halt to 6 days of dizzying positive aspects that propelled Wall Avenue shares to data. Intel Corp. fell greater than 11 per cent in premarket buying and selling after a bleak forecast that additionally pressured know-how shares together with Superior Micro Units Inc. and Nvidia Corp.

The S&P/TSX composite index closed up 0.36 per cent on Thursday.

— Bloomberg

What to observe right this moment

The Division of Finance Canada will publish monetary outcomes for November 2023 this morning.

The thirty fifth Annual Financial Outlook Discussion board, introduced by Scotiabank, takes place in Vancvouer right this moment. The occasion goals to offer some solutions on what companies within the Higher Vancouver area can anticipate from the native and nationwide economic system within the 12 months forward. Panellists will embody economists, trade specialists and political commentators. Keynotes shall be introduced by Jean-Francois Perrault, chief economist, Scotiabank; Jobs Minister Brenda Bailey and Housing Minister Ravi Kahlon.

American Specific Co. and Colgate-Palmolive Co. will report earnings right this moment.

Advisable from Editorial

-

Tips on how to withdraw strategically from this registered plan

-

5 easy methods Canada can get inflation all the way down to 2%

Want a refresher on yesterday’s high headlines? Get caught up right here.

— Further reporting by The Canadian Press, Related Press and Bloomberg

Bookmark our web site and assist our journalism: Don’t miss the enterprise information you want to know — add financialpost.com to your bookmarks and join our newsletters right here.

Article content material