The newest enterprise information because it occurs

Article content material

At the moment’s headlines

Article content material

Prime story

Netflix eliminates ad-free primary plan in Canada, that means value hikes for some

Netflix Inc. is placing the ultimate stake in its most cost-effective, ad-free “primary” plan in Canada.

Commercial 2

Article content material

After asserting final 12 months that it could now not supply the $9.99 plan to new or returning subscribers, the streaming large is phasing out the worth degree solely for customers who had been grandfathered into the plan.

“Primary” subscribers will now want to decide on whether or not to downgrade to a $5.99 plan that features industrial interruptions — and a lot of the Netflix catalogue — or pay extra for the no-ads plans that begin at $16.49 per 30 days.

Netflix advised buyers in its quarterly monetary report on Tuesday that it’ll eradicate the fundamental plan first in Canada and the UK between April and the top of June.

The newest transfer comes as Netflix seems to push extra subscribers to its ad-supported plans, which price much less however are extra profitable for the corporate since they promote advert house.

Many of the largest streaming platforms have not too long ago adopted the same technique.

Amazon.com Inc.’s Prime Video will start displaying commercials on its streaming service in Canada beginning on Feb. 5. It would give subscribers an choice to “opt-out” by paying extra to take away the industrial breaks.

David Good friend, The Canadian Press

Commercial 3

Article content material

4:47 p.m.

Market shut: TSX led greater by power and utilities, U.S. inventory markets additionally rise

Power in power and utilities helped Canada’s essential inventory index publish a modest acquire, whereas U.S. markets additionally moved greater following a stronger-than-expected GDP report.

The S&P/TSX composite index closed up 75.76 factors at 21,101.54.

In New York, the Dow Jones industrial common was up 242.74 factors at 38,049.13. The S&P 500 index was up 25.61 factors at 4,894.16, whereas the Nasdaq composite was up 28.58 factors at 15,510.50.

The Canadian greenback traded for 74.22 cents U.S., in response to XE.com, in contrast with 74.16 cents U.S. on Wednesday.

The March crude contract was up US$2.27 at US$77.36 per barrel and the March pure gasoline contract was down eight cents at US$2.18 per mmBTU.

The February gold contract was up US$1.80 at US$2,017.80 an oz. and the March copper contract was down two cents at US$3.87 a pound.

The Canadian Press

2:45 p.m.

Financial institution of America sharing $800 million inventory reward to retain workers

Financial institution of America Corp. is splitting a roughly US$800 million pool of restricted inventory with the vast majority of its workers, boosting compensation to retain staff even because the financial institution works to maintain a lid on bills.

Article content material

Commercial 4

Article content material

The motivation, which comes on prime of normal compensation, goes to employees who earn as a lot as US$500,000 in complete annual pay, in response to a memo from chief govt Brian Moynihan Thursday. About 97 per cent of the worldwide workforce is eligible. That is the seventh time the agency has paid such awards, which complete greater than US$4.8 billion because the program began in 2017, in response to the memo, which an organization spokesperson confirmed.

“The arduous work of our teammates world wide over the previous 12 months once more produced sturdy outcomes,” Moynihan mentioned within the memo. “This work enabled us to take a position sooner or later, together with in our digital capabilities,” and “in packages and providers designed to assist our teammates get pleasure from lengthy and profitable careers with our firm.”

Earlier this month, the corporate reported US$26.5 billion in web revenue for 2023, down from US$27.5 billion a 12 months earlier. The agency is targeted on holding bills in examine, and used attrition to convey its headcount down nearly two per cent, to 212,985, with out taking a significant severance cost, chief monetary officer Alastair Borthwick mentioned on a name with analysts after outcomes had been launched.

Commercial 5

Article content material

— Bloomberg

12:46 p.m.

Noon markets: Wall Avenue rises after knowledge on U.S. financial system stomps expectations

U.S. shares are ticking greater following alerts that the financial system is rising way more powerfully than economists anticipated.

The S&P 500 was up 0.5 per cent in noon buying and selling and on monitor to set a file for a fifth straight day. The Dow Jones Industrial Common was up 106 factors, or 0.3 per cent, as of 11:30 a.m. Japanese time, and the Nasdaq composite was 0.6 per cent greater.

Worldwide Enterprise Machines Corp. was serving to to guide the market with a acquire of 12.8 per cent after it reported a stronger revenue for the newest quarter than analysts anticipated. It helped offset a ten.4 per cent tumble for Tesla Inc., whose earnings and income fell in need of forecasts. The electrical-vehicle maker additionally warned of notably decrease gross sales progress this 12 months.

However Wall Avenue’s essential focus was on a report indicating the U.S. financial system continues to steam forward, demolishing final 12 months’s forecasts for an imminent recession due to excessive rates of interest.

In Toronto, the S&P/TSX composite index was up 42.35 factors at 21,068.13.

Commercial 6

Article content material

The Canadian Press, The Related Press

11:36 p.m.

Unhealthy Boy Furnishings formally bankrupt after failing to file proposal

Toronto-area furnishings retailer Unhealthy Boy Furnishings Warehouse Ltd. is formally bankrupt.

In November, the corporate filed a discover of intention below the Chapter and Insolvency Act, saying it aimed to restructure its enterprise.

Later the identical month, an Ontario courtroom gave Unhealthy Boy permission to start liquidation gross sales.

It additionally gave the retailer till Jan. 23 to file its restructuring proposal.

However in response to a brand new doc on the web site of chapter trustee KSV Advisory, Unhealthy Boy did not file a cash-flow assertion or proposal in time, and is now deemed to have made an task.

Scott Terrio, supervisor of client insolvency at licensed insolvency trustee agency Hoyes, Michalos & Associates Inc., says which means the corporate is now bankrupt.

The Canadian Press

10:05 a.m.

U.S. shares head for one more file, TSX rises

Shares on Wall Avenue rose towards one other file excessive after knowledge confirmed america financial system stays resilient regardless of the Federal Reserve’s nonetheless elevated charges.

Commercial 7

Article content material

The S&P 500 prolonged this 12 months’s good points up 0.42 per cent and hovering close to the 4,900 mark. The Dow Jones industrial common was up 0.46 per cent, whereas the Nasdaq composite index was up 0.39 per cent.

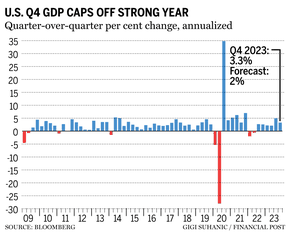

The U.S. financial system expanded within the fourth quarter by greater than forecast, powered by resilient client spending that helped cap the strongest 12 months of progress since 2021. Gross home product elevated at a 3.3 per cent annualized charge. The principle progress engine — private spending — rose at a 2.8 per cent charge.

In Canada, the S&P/TSX composite index was up 0.23 per cent at 21,070.88 on broad-based sector energy.

— Bloombergm Monetary Submit

9:39 a.m.

U.S. GDP grew 3.3 per cent in fourth quarter, trouncing forecasts

The USA financial system’s fourth-quarter progress trounced forecasts as cooling inflation fuelled client spending, capping a surprisingly sturdy 12 months that defied recession calls.

Gross home product elevated at a 3.3 per cent annualized charge, in response to the federal government’s preliminary estimate out Thursday. For all of 2023, the financial system expanded 2.5 per cent.

Commercial 8

Article content material

The financial system’s essential progress engine — private spending — rose at a 2.8 per cent charge. Enterprise funding and housing additionally helped gasoline the larger-than-expected advance final quarter.

A carefully watched measure of underlying inflation rose two per cent for a second straight quarter, in keeping with the Federal Reserve’s goal, the Bureau of Financial Evaluation report confirmed.

Inventory futures rose whereas Treasury yields had been decrease as merchants centered on the inflation figures and boosted the chances of a March charge lower.

The figures wrap up a 12 months during which the financial system confirmed shocking stamina, defying expectations by many Wall Avenue economists that the nation was poised to slide right into a recession.

— Bloomberg

7:30 a.m.

Inventory markets earlier than the opening bell

International shares paused as disappointing outcomes from Tesla Inc. took the sting off the latest rally, and buyers waited to see if the European Central Financial institution would trace at when it would begin reducing rates of interest.

Tesla shares dropped eight per cent in U.S. premarket buying and selling after the electrical automobile maker missed earnings estimates and flagged slower progress this 12 months. Contracts on the Nasdaq 100 traded flat, with merchants looking forward to outcomes from Intel Corp. later within the day.

Commercial 9

Article content material

Whereas Worldwide Enterprise Machines Corp. gained seven per cent after delivering a constructive income outlook, another tech earnings underwhelmed buyers. European chipmaker STMicroelectronics NV dropped after giving weaker gross sales steering, whereas South Korea’s SK Hynix Inc., the world’s No. 2 maker of reminiscence chips, additionally fell after outcomes.

The pause follows a powerful latest run for shares, as buyers have grown assured rates of interest will fall this 12 months and that financial progress is prone to keep resilient.

“We’re nonetheless in a bad-news-is-good-news setting and that if earnings drop a bit and margins tick down, it could be an additional assure that rates of interest will go down,” mentioned Frederic Leroux, head of cross asset at Carmignac Gestion.

— Bloomberg

What to observe right this moment

The survey of employment, payrolls and hours for November can be launched this morning. In america, anticipate preliminary jobless claims, actual GDP for This fall, advance financial indicators for December and sturdy items orders.

The European Central Financial institution will launch its newest rate of interest determination.

Commercial 10

Article content material

Visa Inc., Intel Corp. and American Airways Inc. will launch earnings studies.

New Brunswick Premier Blaine Higgs delivers his annual state of the province tackle this night.

Really helpful from Editorial

-

When economists suppose the Financial institution of Canada will lower charges

-

Retirees have by no means owned so many equities in threat for market

Want a refresher on yesterday’s prime headlines? Get caught up right here.

— Further reporting by The Canadian Press, Related Press and Bloomberg

Bookmark our web site and assist our journalism: Don’t miss the enterprise information it’s essential to know — add financialpost.com to your bookmarks and join our newsletters right here.

Article content material