The newest enterprise information because it occurs

Article content material

As we speak’s prime headlines

Article content material

4:55 p.m.

Market shut: Bond yields fall on indicators Federal Reserve is in ‘candy spot’

Commercial 2

Article content material

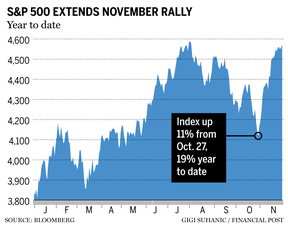

The rally that’s driving international bonds to their greatest month since 2008 gained additional traction, with Treasuries climbing on bets the USA Federal Reserve will begin slicing rates of interest within the first half of 2024.

Hopes for a Fed pivot intensified after financial information emboldened the so-called Goldilocks situation. Two-year yields dropped 10 foundation factors to 4.64 per cent. Fed swaps priced in a quarter-point fee lower by Could.

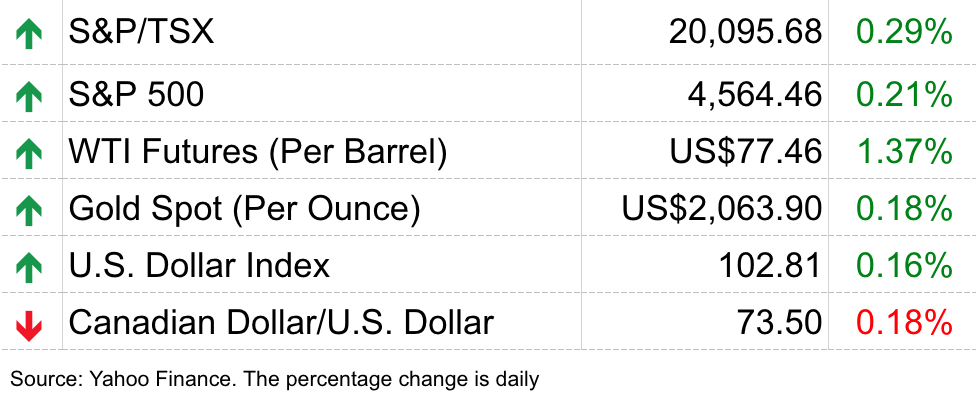

The S&P 500 wavered close to “overbought” ranges. Nvidia Corp. joined positive factors in chipmakers, Tesla Inc. whipsawed within the run-up to its Cybertruck occasion and Microsoft Corp. fell. Oil climbed forward of a high-stakes OPEC+ assembly.

Gross home product rose on the quickest tempo in almost two years, whereas client spending superior at a less-robust fee. The Fed’s most well-liked inflation metric — the non-public consumption expenditures worth index — was revised decrease. U.S. financial exercise slowed in current weeks as customers pulled again on discretionary spending, the Fed stated in its “Beige Guide.”

Bonds prolonged their November rally on hypothesis the Fed is completed with its aggressive mountain climbing cycle. A Bloomberg gauge of worldwide sovereign and company debt has returned about 5 per cent this month, heading for its greatest efficiency for the reason that depths of the recession in December 2008 — when the Fed lower charges to as little as zero and pledged to spice up lending to the monetary sector following the collapse of Lehman Brothers Holdings Inc.

Commercial 3

Article content material

In New York, the Dow Jones industrial common was up 13.44 factors at 35,430.42. The S&P 500 index was down 4.31 factors at 4,550.58, whereas the Nasdaq composite was down 23.27 factors at 14,258.49.

The S&P/TSX composite index closed up 79.43 factors at 20,116.20.

Bloomberg

3:20 p.m.

Labour shortages price small companies $38 billion in misplaced gross sales in 2022: CFIB

Small companies misplaced greater than $38 billion in income alternatives final 12 months due to labour shortages, in response to estimates from the Canadian Federation of Unbiased Enterprise.

CFIB economist Laure-Anne Bomal says staffing shortages led to some employers working extra hours, decreasing their hours of operation and refusing providers or contracts.

Bomal says whereas the quantity doesn’t point out the Canadian economic system misplaced billions of {dollars}, it’s nonetheless a big quantity of income that small companies might have benefitted from.

The report says small companies within the building sector noticed the most important loss in potential enterprise alternatives, estimated to prime $9.6 billion final 12 months, adopted by the retail sector dropping out on an estimated $3.8 billion and social providers with a $3.3 billion loss.

Article content material

Commercial 4

Article content material

Regionally, small companies in Ontario posted the best potential income alternative losses in 2022, estimated at $16 billion, adopted by Quebec and Alberta.

CFIB provided options in its report together with work-integrated studying in highschool for youth, labour mobility of core employees aged 24-64 and tax credit for profession extensions amongst different coverage strategies.

The Canadian Press

1:57 p.m.

Google to pay $100 million a 12 months to Canadian information publishers in take care of Ottawa

Alphabet Inc.’s Google is about to contribute $100 million a 12 months to Canadian information publishers, in a deal that has the Liberal authorities bending to the tech big’s calls for after it threatened to take away information from its platform.

Canadian Heritage Minister Pascale St-Onge introduced at this time that the federal authorities has reached a take care of Google that can profit the information sector.

Ottawa has agreed to set a $100-million yearly cap on funds the corporate will likely be required to make to media firms when the On-line Information Act takes impact on the finish of the 12 months.

The legislation will compel tech giants to enter into agreements with information publishers to pay them for the information content material that seems on their websites, if that content material contributes to revenues.

Commercial 5

Article content material

The quantity introduced at this time is what Google stated it anticipated to pay, and the determine is 41 per cent decrease than the quantity that will’ve been required beneath a method within the authorities’s draft laws.

The deal additionally permits Google to pay right into a single collective bargaining group that can function a media fund.

The Canadian Press

1:50 p.m.

Financial institution of Canada survey individuals largely oppose making a digital loonie

The Financial institution of Canada’s public consultations on the creation of a digital Canadian greenback reveal most respondents are against it.

The central financial institution launched its findings at this time, which present that greater than 80 per cent of respondents strongly oppose the Financial institution of Canada researching and constructing the aptitude to challenge a digital greenback.

The overwhelming majority of respondents additionally say they don’t belief the Financial institution of Canada to challenge a safe digital foreign money.

Among the many prime issues of respondents was privateness, with the questionnaire revealing low ranges of belief in establishments to guard their private information.

The Financial institution of Canada notes the findings don’t essentially mirror the views of the general public as a result of individuals self-selected to answer the questionnaire.

Commercial 6

Article content material

Whereas the general public consultations aimed to gauge curiosity in a digital foreign money, the central financial institution says the choice to create a digital greenback is for Parliament to make. Discover out extra.

The Canadian Press

1 p.m.

Ottawa to pick Boeing navy aircraft in sole-source deal, bypassing Bombardier: sources

The federal authorities is anticipated to announce as early as Thursday that it has chosen Boeing Co. to exchange the navy’s getting old patrol planes in a multibillion-dollar deal, in response to three sources aware of the matter.

The choice to go along with a sole-source contract would shut the door on Quebec-based enterprise jet maker Bombardier Inc., which has been pushing for an open bid.

The sources, who weren’t licensed to talk publicly on the matter, say that final week cupboard green-lit the acquisition of 16 P-8A Poseidon surveillance plane to exchange the half-century-old CP-140 Auroras.

They are saying the Treasury Board held a particular assembly final evening and permitted the contract, which a U.S. company has listed at $US5.9 billion.

The procurement division has acknowledged that Boeing’s off-the-shelf reconnaissance aircraft is the one one out there that meets Royal Canadian Air Pressure necessities, notably round submarine-hunting know-how.

Commercial 7

Article content material

Bombardier has argued that its various — presently a prototype — would supply a less expensive and extra high-tech plane that’s made in Canada.

The Canadian Press

12:33 p.m.

Noon markets: Treasury yields slide on Federal Reserve bets as shares wobble

The rally that’s driving international bonds to their greatest month since 2008 gained additional traction, with Treasuries climbing on bets the USA Federal Reserve will be capable to begin slicing charges within the first half of 2024.

Hopes for a Fed pivot intensified after financial information emboldened the so-called Goldilocks situation. Two-year yields dropped seven foundation factors to 4.67 per cent. Fed swaps priced in a quarter-point fee lower by Could.

The S&P 500 wavered after an advance that drove the gauge towards one among its largest November rallies on report. Megacaps have been combined, with Nvidia Corp. main positive factors in chipmakers and Microsoft Corp. sliding. Oil rose forward of a high-stakes OPEC+ assembly.

A number of block trades supported a steepening of the U.S. curve, with yields on short-dated Treasuries falling greater than these on longer securities. Such trades are set to learn because the U.S. strikes nearer to fee cuts.

Commercial 8

Article content material

In New York, the Dow Jones industrial common was up 9.20 factors at 35,426.18. The S&P 500 index was up 3.07 factors at 4,557.96, whereas the Nasdaq composite was up 3.97 factors at 14,285.73.

In Toronto, The S&P/TSX composite index was up 40.36 factors at 20,077.13.

Bloomberg

12:04 p.m.

Alberta oil executives head to COP28 local weather summit

Executives and senior leaders from Canada’s oil and fuel sector are heading to Dubai for the upcoming United Nations COP28 local weather talks.

The Pathways Alliance consortium of oilsands firms and the Canadian Affiliation of Petroleum Producers are among the many teams who will likely be on the local weather summit representing this nation’s fossil gas business.

The Pathways Alliance says it will the summit as a result of it acknowledges the oilsands is a big emitter of greenhouse gases.

The group says it desires to inform the world it’s dedicated to being a part of the answer. It says it’s keen to speak about a few of its emissions discount plans, together with a proposal to spend $16.5 billion to construct an enormous carbon seize and storage community in northern Alberta.

Commercial 9

Article content material

Janetta McKenzie of unpolluted power think-tank the Pembina Institute says there’s a rising recognition by the oil and fuel sector that it should do extra to fight emissions if it needs to stay aggressive sooner or later.

However she says observers of COP28 have to be looking out for greenwashing, as many oil and fuel firms have thus far made a variety of local weather guarantees however have but to take a position the tens of billions of {dollars} it should take to see these guarantees via.

The Canadian Press

11:42 a.m.

Ottawa reaches take care of Google over controversial On-line Information Act

The federal Liberal authorities has reached a take care of Google over the On-line Information Act, following threats from the digital big that it might take away information from its search platform in Canada.

A authorities official confirmed that information to The Canadian Press beneath situation of anonymity, as a result of they weren’t licensed to talk publicly in regards to the deal.

CBC Information is reporting, citing an unnamed supply, that the settlement would see Canadian information proceed to be shared on Google’s platforms in return for the corporate making annual funds to information firms within the vary of $100 million.

Commercial 10

Article content material

A method within the authorities’s draft laws for the invoice would have seen Google contributing as much as $172 million to information organizations — however Google had stated it was anticipating a determine nearer to $100 million primarily based on a earlier estimate.

The laws, which comes into impact on the finish of the 12 months, requires tech giants to enter into agreements with information publishers to pay them for information content material that seems on their websites, if it helps the tech giants generate cash.

Google had warned that it might block information from its search engine in Canada over the laws, as Meta Platforms Inc. has already achieved on Instagram and Fb.

The Canadian Press

11:09 a.m.

AbCellera, firm that helped develop COVID-19 therapy, to put off 10 per cent of workforce

The Vancouver-based firm that helped develop the primary antibody remedy therapy for COVID-19 has introduced layoffs amounting to 10 per cent of its workforce.

AbCellera Biologics Inc., introduced the cuts in a submitting to the USA Securities and Alternate Fee.

The submitting says the layoffs and reorganization will assist it “focus its efforts towards the scientific improvement of latest antibody medicines for sufferers.”

Commercial 11

Article content material

In Could, AbCellera introduced a $701-million infrastructure venture to spice up the general scope of its Vancouver manufacturing plant.

The corporate stated the plan, backed by greater than $375 million in federal and British Columbia funding, additionally included scientific trials.

AbCellera’s assertion to the SEC says it estimates it should incur roughly US$2.5 million in money expense associated to the layoffs however, with greater than US$1 billion in out there liquidity, it says it has ample capital to “execute on its technique” past the following three years.

The Canadian Press

10:21 a.m.

Markets open: Shares rise as ‘Goldilocks narrative continues’

Shares prolonged one among their largest November rallies on report amid bets the Unites States Federal Reserve will pull off a smooth touchdown because the economic system stays pretty sturdy and inflation exhibits indicators of cooling.

All main teams within the S&P 500 superior, with the gauge approaching 4,600 and heading towards its highest since July.

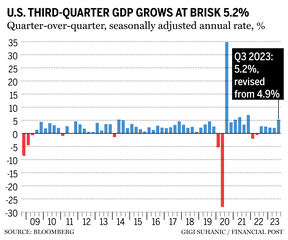

Gross home product rose at an upwardly revised 5.2 per cent annualized tempo within the third quarter, the quickest in almost two years. Client spending superior at a less-robust 3.6 per cent fee. The Fed’s most well-liked inflation metric — the non-public consumption expenditures worth index — was revised all the way down to a 2.8 per cent annual fee within the third quarter. Excluding meals and power, the gauge was additionally marked decrease to 2.3 per cent.

Commercial 12

Article content material

To John Leiper at Titan Asset Administration, the information highlighted the power of the economic system. Meantime, the drop within the core PCE worth index will likely be interpreted by Fed officers as an indication their technique stays on monitor they usually might effectively obtain a smooth touchdown situation. “The Goldilocks narrative continues for now,” he stated.

On Wall Avenue, the S&P 500 was up 0.39 per cent at 4,572.64. The Dow Jones Industrial Common was up 0.06 per cent at 35,435.12 whereas the Nasdaq composite was up 0.37. per cent at 14,334.60.

In Toronto, the S&P/TSX composite index was up 0.21 per cent at 20,078.35. Learn extra.

Bloomberg

9 a.m.

U.S. economic system grows at quickest fee in two years

Shrugging off increased rates of interest, America’s customers spent sufficient to assist drive the economic system to a brisk 5.2 per cent annual tempo from July via September, the federal government reported Wednesday in an improve from its earlier estimate.

The federal government had beforehand estimated that the economic system grew at a 4.9 per cent annual fee final quarter.

Wednesday’s second estimate of progress for the July-September quarter confirmed that the economic system sharply accelerated from its 2.1 per cent fee from April via June. It confirmed that the U.S. gross home product — the full output of products and providers — grew at its quickest quarterly fee in almost two years.

Commercial 13

Article content material

The Related Press

8:10 a.m.

Enbridge to spice up dividend

Enbridge Inc. is elevating its dividend because it expects its enterprise to proceed to develop subsequent 12 months.

The corporate additionally reaffirmed its full 12 months steerage for 2023 for earnings earlier than curiosity, earnings taxes and depreciation and distributable money circulate.

Enbridge says it should pay a quarterly dividend of 91.5 cents per share, efficient with the dividend payable on March 1, 2024, up from 88.75 cents per share.

The elevated cost to shareholders will come as the corporate expects 2024 adjusted EBITDA on its base enterprise to complete $16.6 billion to $17.2 billion. Distributable money circulate per share is anticipated between $5.40 and $5.80.

Enbridge says the ranges for 2024 represents progress of 4 per cent for its base enterprise EBITDA and three per cent for its distributable money circulate in contrast with the midpoint of its 2023 steerage.

The steerage doesn’t embody the affect of the U.S. fuel utility acquisitions introduced in September which can be anticipated to shut throughout 2024.

The Canadian Press

7:30 a.m.

OECD warns world headed for deepening slowdown

Commercial 14

Article content material

The world’s superior economies are heading right into a deepening slowdown as markedly increased rates of interest take a hefty toll on exercise that might nonetheless change into extra acute, the OECD warned.

Progress is dropping momentum in lots of nations and gained’t edge up till 2025, when actual incomes get better from the inflation shock and central banks could have begun slicing borrowing prices, the Paris-based group stated.

It forecasts international gross home product to broaden solely 2.7 per cent subsequent 12 months after an already weak 2.9 per cent in 2023. The tempo will solely choose as much as 3 per cent in 2025, in response to the evaluation.

Furthermore, the OECD stated the dangers to the forecast are tilted downwards amid heightened geopolitical tensions, an unsure outlook for commerce, and the chance that tight financial coverage might harm companies, client spending and employment greater than anticipated.

It expects rate of interest cuts in the USA will solely start within the second half of 2024, and never till the spring of 2025 within the euro space. That contrasts starkly with the expectations of markets, that are presently pricing the Federal Reserve and the European Central Financial institution will ease coverage as quickly as the primary half of subsequent 12 months.

Commercial 15

Article content material

Learn extra

Bloomberg

Inventory markets earlier than the opening bell

Shares are rising this morning on expectations that the Federal Reserve is completed with coverage tightening and should begin slicing rates of interest subsequent 12 months.

The optimism comes after Fed Governor Christopher Waller prompt the central financial institution is effectively positioned to push inflation to a 2 per cent goal. Billionaire investor Invoice Ackman additionally stated Tuesday he’s betting Fed cuts might come as quickly as the primary quarter — sooner than market pricing is suggesting.

Oil climbed for a second day as merchants awaited a high-stakes OPEC+ assembly on provide. Gold prolonged positive factors to its highest degree since Could, additionally buoyed by hopes of a Fed coverage shift.

Bloomberg

What to look at at this time

Ottawa will maintain a briefing on Canada’s priorities and aims for the United Nations Local weather Change Convention, happening in Dubai, United Arab Emirates, from Nov. 30 to Dec. 12.

In information out at this time, the USA will get a studying on gross home product and the discharge of the Federal Reserve beige ebook.

In Canada it’s the present account stability.

Associated Tales

-

Panama says it should shut down First Quantum mine

-

Cybertruck is already a manufacturing nightmare for Tesla

Want a refresher on yesterday’s prime headlines? Get caught up right here.

Extra reporting by The Canadian Press, Related Press and Bloomberg

Article content material